What is Recapture Tax?

Recapture is a tax that borrowers may have to pay on their federal income tax returns when they sell their Montana Housing financed homes. Montana Housing loans are financed with Mortgage Revenue Bonds (MRB) and the Internal Revenue Service (IRS) code states there may be a recapture tax owed by the borrowers.

In 1989, a Federal law was passed which provides for a “recapture tax” on the gain from a borrower’s sale of a residence financed with an MRB. This provision is administered by the IRS. When a homebuyer receives an MRB loan or a Mortgage Credit Certificate (MCC), they are receiving the benefit of a federal income tax credit. The IRS defines these benefits as a "federal subsidy benefit‟ or "public benefit‟ and the law mandates a “recapture” of some of the benefit of the program that is not customarily available with other mortgage loans.

What are the conditions where recapture applies?

A borrower will owe recapture tax only if ALL the following are true:

- The home is sold within nine years of the closing date; and

- The homeowner realizes a gain on the sale of the home; and

- The homeowner’s family income has increased significantly and exceeds the limits established by the IRS. IRS limits increase annually by 5%.

If any of these three criteria do not apply, there is no recapture tax.

Limits on Recapture Tax

If the three criteria listed above are met, then a portion of the gain received will be due as a recapture tax. The maximum tax is 6.25% of the original loan amount or 50% of the gain on the sale, whichever is less. Gain is calculated after items such as real estate agent, legal and closing fees have been deducted from the proceeds of the sale.

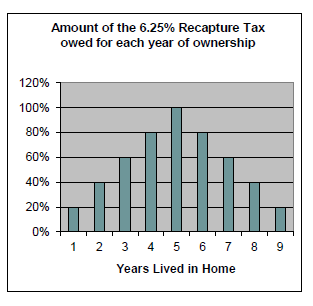

Recapture taxes are figured on a scale based on the number of years the borrower has lived in the house, with the fifth year potentially being the costliest time to sell as that is when the maximum recapture tax due rises to 6.25% percent.

Whether recapture tax is due, borrowers must file IRS Form 8828 with their federal income tax returns for the year in which their home is sold. If recapture is due, it is paid to the IRS as part of the homeowner’s federal income tax liability for the year the home is sold.

For more information

Contact the IRS and request Form 8828 and the instructions for Form 8828. If you have questions about the details of the recapture tax and whether the tax applies to the sale of your home, consult with a certified tax professional.

Disclaimer: This is a brief overview of complex IRS guidelines. Homeowners are always encouraged to seek advice from their tax professional specific to their situation.

Frequently Asked Questions