Current Rates

All rates are fixed and effective dates vary for each.

Regular Loan Program5.75% Effective: 12/01/23

MBOH Plus 0% Deferred DPA Loan Program 6.00% 1st Mortgage Interest Rate - Effective 12/01/23

0.00% 2nd Mortgage Interest Rate (*APR 0.30% based on $6,500 loan)

5.50% Effective: 12/01/23

Montana Veterans Home Loan Program4.75% Effective: 07/25/24 (Changes bi-weekly)

Bond Advantage DPA Program 6.00% 1st Mortgage Interest Rate - Effective: 12/01/23

6.00% 2nd Mortgage Interest Rate (15 Yr Term) - Effective: 12/01/23

80%Combined Program

6.00% Effective: 07/25/24 (Changes bi-weekly)

Habitat for Humanity

2.00%

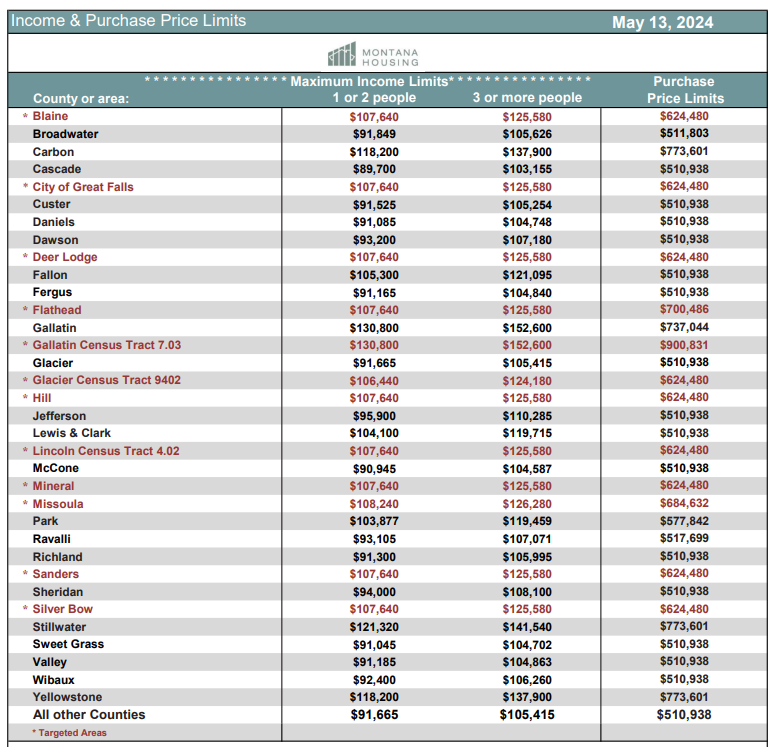

Income and Purchase Price Limits

To be eligible for a Montana Housing loan, the purchase price and total annual household income cannot exceed the limits below. Exception for the Montana Veterans’ Home Loan Program* and MBOH Plus 0% Deferred Down Payment Assistance Program** are noted.

The limits listed below apply to the Regular Bond Program, Bond Advantage (DPA) Program, 80% Combined Program and Mortgage Credit Certificate Program.

For those counties which are not listed, Montana Housing uses the income and purchase price limits labeled “ALL OTHER AREAS” set forth at the end of the list of counties.*Montana Veterans’ Home Loan Program has a Loan amount limit of $485,391. No income, purchase price or asset limits apply. Borrower must be a true first-time homebuyer, never owned their principal residence, targeted areas do not apply to this program.

**The MBOH 0% Deferred Down Payment Assistance Program has an income limit of $80,000 for small household (1-2 ppl) and $90,000 for large household (3+).

Click here for a printable PDF version

How to calculate income

Montana Housing must consider household income, which can be different than the qualifying income the lender uses for underwriting purposes.The guide below can be helpful in calculating household income.

Click here to return to the LENDER website